Oro Gold Mine Documents – Margarita Project

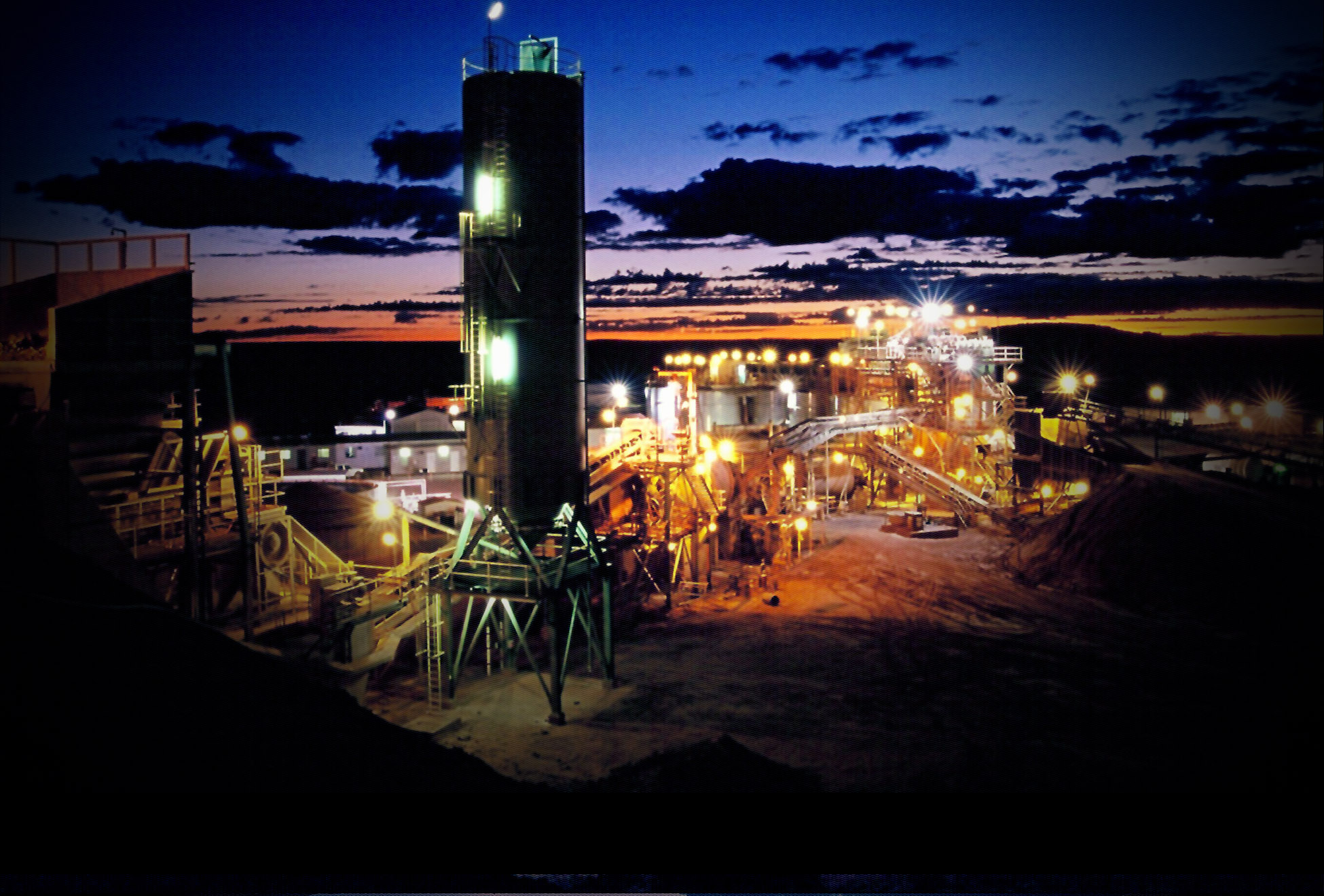

18. Goodmark Capital Group, Inc. (2019-2022 UPDATE): GoodMark has installed quite a bit of new equipment on our Mill site to expand our operations. We are projecting to begin production from our expanded milling operation in 2022 utilizing our actively working onsite processing crew.

GoodMark has a large amount of claim acreage to produce ore from and in addition, we have added another source of high mineralization ore. This additional ore has been shown through Induced Coupled Polarization (ICP) and Fire Assay Testing to have an extreme market value per ton.

The testing indicated Gold and Silver and other Industrial Metals as well as Platinum Sister Metals and Rare Earth Elements.

17. Goodmark Capital Group, Inc. (2017-2018 UPDATE): Assay and gravity concentration test of our now claimed Oro Gold Mine extended areas. GoodMark Capital Group, Inc. has now claimed up 108 Claims total including our origional Oro Gold Mine and newly acquired extended area plus our Sulfide Claims to the north (Previously Known As The Idaho Mine Group) and The Choctaw Mine. (NEW TOTAL CLAIMS ACERAGE IS AS FOLLOWS: 2,189.96+15.75+18.06=2,22

Our mining crew performed assay testing that showed averages of 1.43 Ounces Of Gold Per Ton and 8.93 Ounces of Silver Per Ton in these new areas. Click on the links below to show our test results, new claim information, location maps and photographs etc.

Click on the links below to show our test results, new claim information, location maps and photographs etc. 1. Assay Report to Mark-1 5-27-17-r , 2. Platt Maps For Claims, 3. Numbered Claim Block Diagram , 4. Topographical Claim Block Map , 5. Our First Mill , 6. Collage

(click on link and friend us on facebkook to see our latest project development photos)–> https://www.facebook.com/GoodMarkCapitalGroup

16. Goodmark Capital Group, Inc. (2014-2016): 81 sample assay and gravity concentration test of Oro Gold Mine our mining crew performed. Assay average on productive samples with a cut off rate of (.005) ounces of gold per ton of raw material not including trace samples showed (.477731707 ) ounces of gold per ton of raw material.click on the links to show our test results, claim information, location maps etc.

Click on the links below to show our test results, claim information, location maps etc.

- NORTH-STAR-MINING Report and Directory 101916r

- GoodMark BLM Current List of Arizona ORO Mining Claims 102814r-

- Oro Gold Mine Location Maps

15. Hellix Ventures, Inc. (2012): Completed a total of twelve vertical HQ size rotary diamond drill holes to a maximum depth of 100 feet to confirm the past historic testing programs that have been performed on the property. The samples were collected, selected, handled and delivered to Skyline Laboratories in Tucson, Arizona by an independent Registered Geologist in charge of the QA/QC program on this project. Sample procedures were followed that meet the requirements for NI 43-101 reporting. Standards and blanks were inserted at prescribed intervals in each hole as well as a second re-sample of one reject material interval from each hole. Standards were provided from a reputable independent geochemical contractor.(HELLIX VENTURES INC. HEL:TSX.V / HLLXF:OTC -Vancouver, BC- Frank Underhill, President.) GoodMark Capital Group, Inc. has the core samples from Hellix’s rotary drill program in storage in Nogales, AZ. (click on the links to show Hellix Ventures, Inc test results and United States Bureau Of Mines (USBM) test results data included in report etc.)

- Hellix Drops Margarita Lease (Link To Their Website)

- Hellix Ventures drilling-assays and drill logs from 2012-12 core drill holes. (We have the core samples from this 1,200 feet of drilling)

- Section 3 Arizona Mine Update With Directory 101916r (Compilation Of Press Releases By Hellix Ventures, Inc.-USBM Test Results)

- ALS Minerals Certificate Of Analysis RE12090027

- ALS Minerals Certificate Of Analysis RE12108057

- ALS Minerals Certificate Of Analysis VA12110295

- ALS Minerals Certificate Of Analysis VA12110614

- Hellix Rock Chip And Pulp Analysis And Full Analyte Report

- Skyline Assayers and Laboratories Specific Gravity And Weight Report

14. Rock Resources (RKR/CDNX) (2001-2002): Rock Resources geological team completed a VLF EM (very low frequency electro magnetic) survey over the grid to a chargeability depth of 200 ft. The Company hired Peter E. Wolcott & Associates Limited to perform a 16 km (10 mile) Induced Polarization Survey (IP) over the surveyed area in August 2002 to test for steep dipping quartz filled structures hosting vein gold mineralization.

- Rock Resources in March 2001 Released Information That The Margarita Property Has A Drill Indicated Open Pit Resource Of 439,000 Tons And Significant Potential For Increased Gold reserves At Depth

- Rock Resources in March 2001 Released Information That At The Margarita Property There Appears To Be Potential For Stacked Ore Bodies Seperated By 10-50 Foot Intervals.

- EM-16 Electromagnetic Survey-Peter E Wolcott and Associates LTD

- IPS-Induced Polarization Survey-Peter E Wolcott and Associates LTD

- Induced Polarization Survey Contours Of Apparent Chargeability

- Induced Polarization Survey Contours Of Apparent Resistivity

13. La Teko Mines Ltd. – Now owned by Kinross (LAORF/NASDAQ) 1991-96): Jeff Rogers of La Teko completed a total of 14 holes totaling 4000 feet of reverse circulating drilling to a maximum depth of 400 feet with a recommendation of additional mapping, sampling and data compilation based on a estimated potential of 2.3 million tons.

- La Teko June 17, 1988 Purchases Margarite

- La Teko June 8, 1989 Receives 500,000 Ton Extraction Permit with Access To Ground Water

12. United States Bureau Of Mines (1994): Test Program showed as high as 7.17 OPT AG (Silver) In USBM MLA 24-94 (316 Pages; 21.8 mb):

https://www.goodmarkcapitalgroup.com/wp-content/uploads/2022/03/USBM_MLA_024-94.pdf

11. Newfields Minerals Inc. (NASDAQ symbol: NWMIF) (1987-91): D. McKee prepared a Preliminary Feasibility study for Newfields Minerals Inc. estimating the cost of mining and processing at $10.45 per ton (1987). Steven Van Nort (1986) made an independent evaluation using the data from the study calculation a resource of 440,000 tons equaling 31,680 oz. gold.

- Newfields Minerals Indicates Potential In 1987 Of 20,000,000 Tons Of Minable Ore At Margarita

- Newfields Minerals Estimates Potential In 1987 Of 1,000,000 Ounces Of Recoverable Gold Bullion At Margarita

10. Pirates Gold Corporation (PIGO) (1985): During 1985, a program of exploration was conducted for Pirates Gold Corporation by J.H. Montgomery, PH.D., P. Eng. Montgomery Consultants Ltd. For the purpose of a geostatistical reserve estimation a total of 233 drill holes were selected by G.H. Giroux, Ma. Sc., P. Eng. of Montgomery Consultants Ltd. showing 482,000 tons equaling 22,700 oz. gold reserve estimate. It is likely that the estimates would fall in the category of indicated mineral resources as set out in NI 43-101.

9. Sonora Exploration and Mining Co. (1984): In 1984 M.H. Johnson also made reserve estimates. He calculated a mineable reserve of 328,600 tons equaling 20,045 oz. gold.

8. Amax Mining (1984): Using all available drill hole data, Amax made a reserve calculation of 516,000 tons equaling 27,864 oz. gold.

7. Golden Concord Mining Corporation (1983): 40 air track holes drilled and from the results (Drill hole data is available for most off the holes but final reports were unavailable) they recommended an additional 155 air-track holes, 2000 feet of diamond drilling and metallurgical testing

6. Airborne Minerals Consultants International Inc. (1981-1984): Mr. Fred Brost, P.E. performed metallurgical tests on material from the mine in 1981 and 1984. On mine run material, recoveries of 37.8% gold and 26.35% silver were attained in a 14 day period. When crushed to -0.5 inches and agglomerated, recoveries were 92.46% for gold in 14 days.

5. Studsvik Analytics AB (1982): 17 air-track drill holes totaling 1510 feet and 16 rotary drill holes totaling 3500 feet calculated reserves at 214,000 tons equaling 13,696 oz. gold including encountering gold values at depths of 230 and 390 feet associated within strongly fractured zones. This figure could be termed a drill-indicated resource.

4. Dekalb Mining Inc. (1982): Surface sampling program and their study of the distribution of silicified zones showed their estimated possible and potential reserves tonnage to be 2.5 to 7.5 million tons equaling 150,000 to 450.000 oz. gold.

3. Homestake Mining Company (1982): A total of 353 rock samples tested showed values up to 0.13 oz./ton gold.

2. Apache International Mining G.S.A. Resources (1980-85): 32 hole air-track drilling program totaling 2360 feet reported a calculated reserve of 220,000 tons equaling 13,200 oz. gold.

1. Pittsburg Glass Industries (PPG) (1976): 29 air-track holes to ranging in depths of 75 to 100 feet showed values up to 0.24 oz./ton gold.